Move from Mass to Micro to Grow Wine Sales

My thoughts on how wine producers, distributors and retailers can leverage Artificial Intelligence (AI) to help deliver profitable growth by moving from mass to micro.

This blog combines my two passions: Strategy + Wine. I muse over strategic topics in the wine industry and how to create winning strategies.

It’s no secret the USD 30 billion global wine industry is in challenging times. The challenges range from climate change, overproduction, declining consumption, labor scarcity, social moderation, technological advances, and anti-alcohol legislation. According to the International Organisation of Vine and Wines[1] (OIV), global wine consumption was down 2.6% in 2023, culminating in the lowest consumption volume since 1996. In the U.S., consumption was down 3% in 2023, mirroring trends in Italy and France. While overall U.S. wine consumption is down, there are pockets of customer and market growth, and wine companies should tap into these to help deliver profitable growth.

Today’s diverse consumers are increasingly driving wine companies to transition from a supply-focus to a demand-driven model. This pivot marks an important transition from a mass-market approach to strategies that can prioritize relevance for specific consumer groups, in specific markets. The shift to micro involves wine companies moving from large-scale decision-making and annual planning to embedding granular customer and market insights, and adaptive decision-making into every facet of the value chain. However, it can be daunting to analyze data at the zip-code market level from different sources such as syndicated market data, e-commerce data, firmographic data, transactional and trade spend data, and credit card and receipt data. This is where AI comes into the picture.

I thought it would be helpful to illustrate how AI can be leveraged to drive growth, with an actual example from a leading wine and spirits company in the U.S. The company wanted to better understand how its high-level growth objectives could be distilled into concrete market-level targets, then turn those insights into specific action. In some cases, this meant changing the wholesaler in a specific region, doing more local marketing activation to increase brand awareness, changing local pricing, and optimizing the product portfolio, tailored to each market.

By combining internal data such as category size, category, and varietal growth, with external data such as localized market share, and market potential and growth, the client leveraged AI to create a data-rich picture of micro-markets at the zip-code level that did not exist previously, purpose-built to indicate potential sources of local growth. A Generative AI (GenAI) model was created that enabled the Sales & Marketing teams to ask specific questions such as “what are the best growth opportunities for Brand X in the Houston area within the independent channel?”

To move from automated insights to actions, a set of priority commercial growth levers were used such as distribution, awareness, innovation, price and mix to address the growth potential by micro-market. While each growth lever was typically applicable to many micro-markets, the proportional revenue growth they each drove varied based on market-specific dynamics. The AI model was trained on historical data to identify what growth drivers were most effective for different types of micro-markets. The micro-markets were prioritized based on the potential size of prize, including factors such as market size, market growth, expected market share, company growth and company market share. Clearly defined plans were then generated appropriate for each prioritized micro-market’s competitive landscape, historical trends, and regulatory environment. One of the opportunity markets was Texas, where specific distribution, awareness, innovation, pricing, and mix recommendations were made, such as gain distribution in specific liquor stores, increase local price of specific SKUs, emphasize particular sub-categories, and expand premium options for certain brands.

By leading with strategic priorities and following an iterative design approach, the company focused sales and marketing efforts on the biggest opportunities, balanced competing market signals, and created flexibility for more enhanced data over time to train the AI model.

In total, the wine and spirits company identified significant new organic growth opportunities, and effectively prioritized and delivered consistent growth actions with clear responsibility for execution for specific markets. Traditionally, it would have been difficult to deliver a program at this scale with detailed micro-market data, but with AI, it is now possible to analyze large amounts of data and identify patterns and historical growth levers at a micro-level. It can enable wine companies to move from mass to micro in the future.

About me

Musings of a Strategist about Wine

I am a Corporate Strategist and Wine Enthusiast. I have been for almost 30 years. Today, I am a Principal at Deloitte Consulting LLP focusing on the Food & Beverage industry, and advising boards and executives on growth, and digital business transformation. I hold a Doctor of Business Administration (DBA) in Business Model Innovation. I am part of the Master of Wine program, and I am a DipWSET, Certified Sommelier, and a UC Davis wine program graduate.

This publication contains general information only and Deloitte is not, by means of this publication, rendering accounting, business, financial, investment, legal, tax, or other professional advice or services. This publication is not a substitute for such professional advice or services, nor should it be used as a basis for any decision or action that may affect your business. Before making any decision or taking any action that may affect your business, you should consult a qualified professional advisor.

Deloitte shall not be responsible for any loss sustained by any person who relies on this publication.

[1] International Organisation of Vine and Wines; State of the World Vine and Wine Sector in 2023.

What are the most important strategic issues to wine producers today?

What I learned from analyzing +10,000 public documents using AI.

It’s no secret the wine industry is in challenging times right now. It’s changing rapidly due to shifting consumer preferences, inflation, trade tariffs, climate change, and new competitors. In these uncertain times, global wine sales volume has been down 5% to 6% over the last 18 months, adding to wine industry worries.

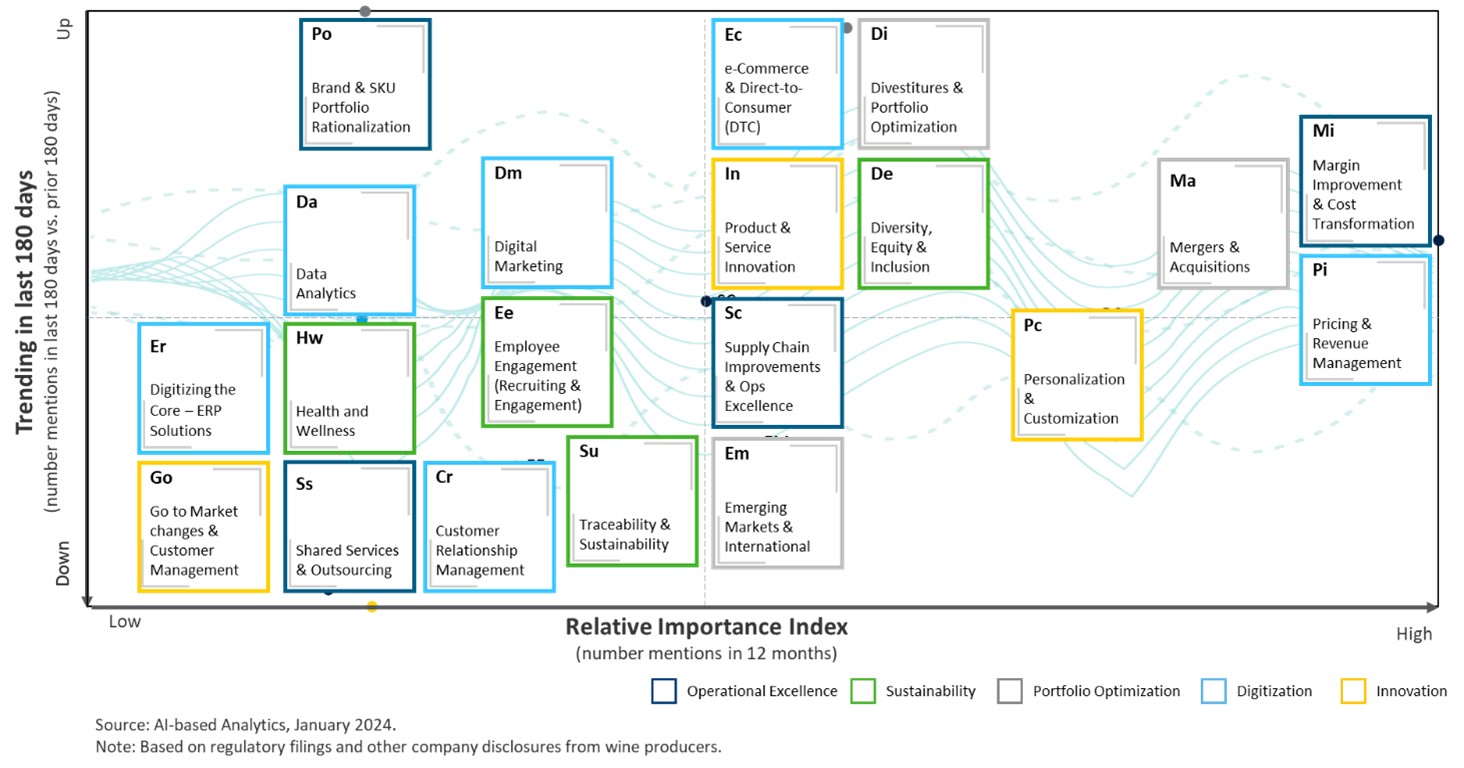

With that context, I wanted to understand the strategic issues important to leading wine producers. To do this, I analyzed +10,000 public statements and reports from 25 large public and private wine producers from across the USA, Australia, and Europe, using an AI-based research platform.

Here are the most important strategic issues in the last 12 months and how they are trending:

The analysis is split into ’Relative Importance’ based on the total number of mentions of the strategic topic in the last 12 months, and the percentage change in mentions in the last 180 days (’Trending’.) The AI helped interpret the strategic issues (e.g., Margin Improvement & Cost Transformation) to ensure adjacent terms were included (e.g., cost reduction, SG&A reduction, restructuring, etc.). What the analysis shows is there are four strategic issues – Margin Improvement & Cost Transformation, Pricing & Revenue Management, Mergers & Acquisitions, and Personalization & Customization – that are most important to wine producers today.

Let’s look at what the wine producers are saying about these four important strategic issues:

Pricing & Revenue Management

Pricing and revenue management is one of the most powerful levers for driving profitable growth and is top of the Executive agenda. Some of the trends we saw during COVID-19 are here to stay. Shifts in consumer preferences (private label, value retailers, decreasing loyalty, price transparency), and supply chain impacts have required wine producers to re-think their pricing strategy and execution.

For the last few years, the playbook for wine producers centered on price taking. Input costs rose dramatically, so price had to follow. Companies did all they could to control costs to limit pass-through, and premiumization helped justify what they charged. But the name of the game was price.

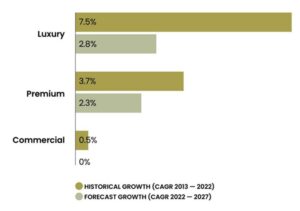

But the world is changing. Further significant price increases might not be possible in an uncertain economy where retailers are pushing back, consumers are unwilling to pay more, and competitors are becoming more aggressive on price. The shift to premium and luxury price segments will likely slow down and become less important as a growth driver in the future (see below forecast from IWSR).

Source: IWSR 2022, still and sparkling wine only, portfolio price points per IWSR segmentation, value growth shown

If price and premiumization have run their course, wine producers will need to pivot to volume. But not all volume is equal. Companies must pay renewed attention to execution, driven by a clear eye on profitable volume.

Margin Improvement & Cost Transformation

The pricing and premiumization challenges are exacerbated by rising costs of goods and labor, which are putting pressure on margins. While rising costs hit hard at any level, it’s the lower priced wines that are the most vulnerable. The increasing cost of glass, labor, cardboard, fuel to transport eat into profit. If you are going to make profit at that low end and still deliver a product that is quality, the trends are tough below $12 a bottle.

Wine producers are improving their margin by discarding poor performers. In 2022 and 2023, wine producers did a fair amount of SKU rationalization to free up production capacity and pruning away low-performing products and brands to increase the average mix margin. This trend of SKU rationalization will likely continue as a priority for 2024. More radical changes to mix involve divesting entire brands or lines of business as we saw with Constellation Brands selling five wineries and more than 30 U.S. wine brands to E&J Gallo. Improving supply chain performance was another key theme in transforming the cost base. Wine producers took measures to streamline supply chains, review grower contracts, and restructure operations. While the industry has tried to address supply chain challenges over the last few years, more progress is needed, and will likely be another focus area in 2024.

Mergers & Acquisitions

The challenging times are putting many wineries into a stress-test environment. Some brands are selling because financially, with margins tightening in the industry, they just do not have anywhere to go. Most small family wineries have an operating line of credit and when interest rates shot up to 8% or 9% last year, it became difficult to operate and make money. In the first half of 2023, the industry saw 11 major deals. The second half brought Duckhorn’s $400 million purchase of Sonoma-Cutrer, Treasury Wine Estates’ acquisition of Daou for up to $1 billion, and Gallo’s purchase of Rombauer and Massican in the USA.

High-interest rates may dissuade private equity investors, several of which use debt funding for acquisitions. That dynamic gives wine producers with strong corporate balance sheets an advantage when competing for deals. “Bolt-on” acquisitions is the phrase most used by executives in investor calls. However, vertical integration may help companies gain greater control of their value chain, ensure supply, and protect margins from input cost increases.

Personalization & Customization

With consumer preferences and consumption changing, how did wine producers grow loyalty among current consumers and reach out to new ones? Wine producers felt it was an important part of their strategic growth to create a more direct connection with customers and consumers enabled through owned distribution. In emerging markets, this was particularly important. Companies focused on converting consumers who already bought their brands from third-party retailers and transitioning their current Direct-to-Consumer (DTC) customers to a loyalty program or subscription service. Increasingly, personalized buying experiences that embrace shared beliefs are becoming an expectation.

Innovation in Personalization & Customization was focused on format, channel, and occasion. Enabling customization and transparency through tech is one way to evolve new customer engagement, such as embracing emerging technology to trace grapes from vineyard to glass, or creating an online-to-offline experience that maps to occasion-based purchase triggers.

I highlighted the four most important strategic issues for wine producers based on the relative importance. However, there are other issues that are becoming important such as e-Commerce/DTC, Product & Service Innovation, Diversity, Equity & Inclusion, and Divestitures & Portfolio Optimization, and I will cover these in another post on what’s going on in the wine industry.

Share this:

Social

Most Popular

Categories

Follow Site Via Email

Enter your email address to follow this site and receive notifications of new posts by email.